Here is CIRAS’s quick look at major economic indicators, our assessment of Iowa’s industrial economy, and recommendations for you as a business leader. For an introduction and a description of the indicators used, see our first post.

| Indicator | Status | Underlying Data |

Notes |

| ISM Manufacturing PMI® | Nearly all indicators remained above neutral, demonstrating continued moderate growth of manufacturing nationally. | ||

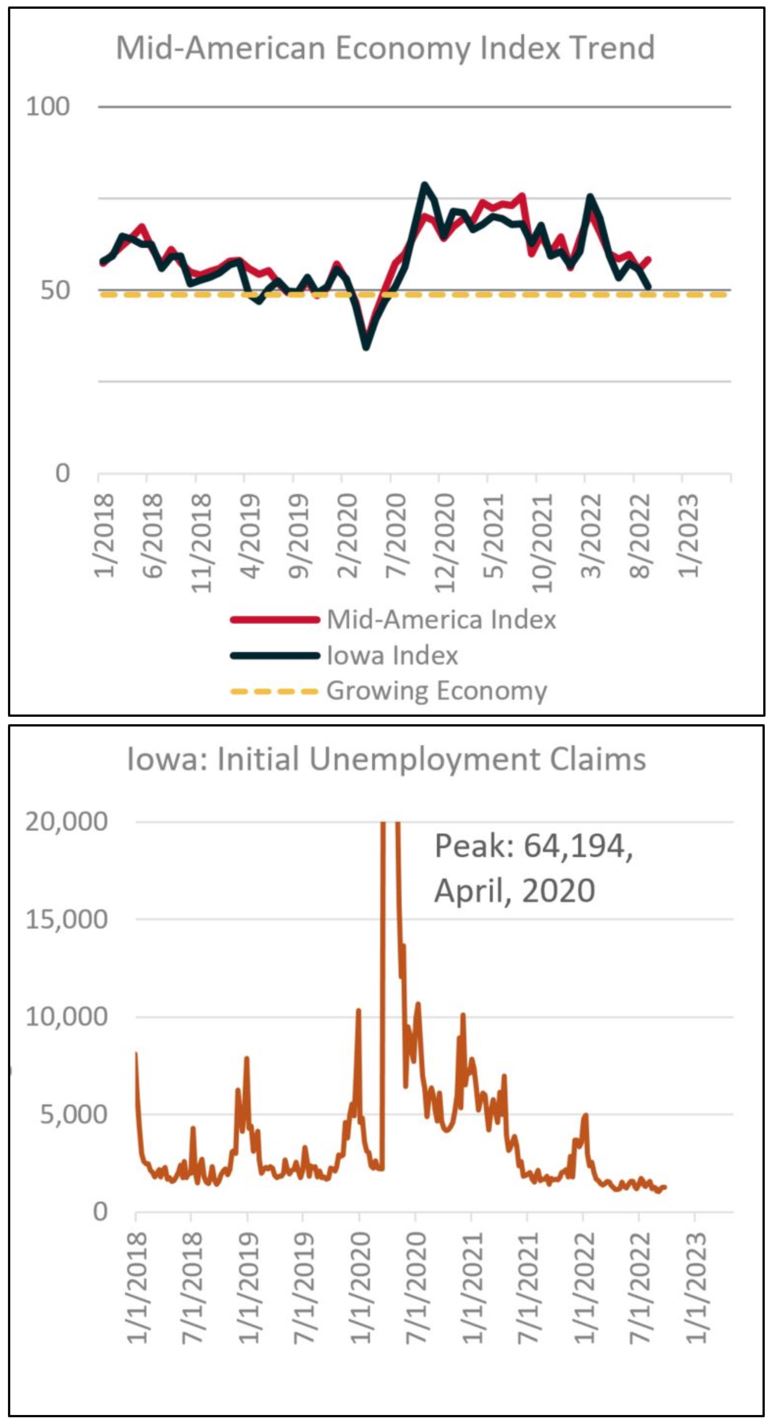

| Mid-American Index | Sharply increasing inventories, prices, and employment offset contraction in new orders and production. | ||

| Iowa Index | Increasing inventories offset moderate contraction in new orders and production. | ||

| Iowa New Unemployment Claims | Initial unemployment claims remain historically low. |

CIRAS Assessment

Current data provides mixed but generally positive signals on Iowa’s industrial economy. Inventories continue to grow, with softening of new orders and production. This demonstrates some signs of the supply chain constraints easing. We will be watching for demand stabilization over the next few months.

The two biggest risks currently are a global demand drop and inventory-induced demand drops. While former is largely out of your control, you can get a handle on the latter.

First, call your top customers and ask: How much inventory of our product do you have, and how does that compare to history? This should help you understand how much they have inflated your demand with safety stock.

Second, call critical suppliers and make sure they know where you stand on their inventory. This will help them improve their planning.

As we try to reestablish more normal supply patterns while dealing with global uncertainty, communication is key.

If you would like a brief monthly digest with updated indicators click here to subscribe. For more information, contact your local account manager or government contracting specialist.