An employee stock ownership plan (ESOP) can be a powerful tool for saving jobs, recruiting top talent, retaining people, and building retirement wealth. And white it may not be the best option for all companies, a growing number of Iowa businesses are finding success in using ESOPs to meet their workforce objectives.

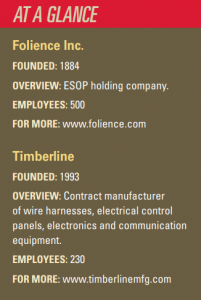

Folience Inc. is a Cedar Rapids-based umbrella company that evolved into its current form in 2017. Its media industry holdings, including the Cedar Rapids Gazette, date back to 1884. Also in 2017, Folience diversified into manufacturing with the acquisition of Life Line Emergency Vehicles, a custom ambulance manufacturer in Sumner. Purchasing the privately held business and converting it to a 100% ESOP ensured the future of the company and the 180 jobs it provides.

“It’s about keeping jobs and tax dollars in our communities,” said Daniel Goldstein, Folience president and CEO. “The data I’ve seen for Iowa suggest that nearly 29,000 businesses will transition ownership over the next decade. For many companies, the choice will be to sell or close. If a business is sold to a private equity firm, which often happens, statistics show it will be up for sale again in three to five years, or it will be moved out of the community to be merged or

consolidated with a larger corporation.”

“With employee ownership, you’re investing in the people and the community. No employee is ever going to vote to send their job out of state,” Goldstein added.

Goldstein also credits employee ownership with improved safety, better productivity, greater profitability, and an overall better workplace environment.

“These are things that keep employees,” he said. “We’ve had employees stay into their fourth decade; that’s an astounding level of retention.”

With an ESOP, employees own shares in their company. At Folience, 90% contribute to their 401(k) with an average contribution of 7.58%, which is matched with company stock. They also earn an annual allocation of company stock, regardless of their 401(k) participation.

“The majority of our employees are on track to accumulate the wealth they need to fully fund their retirement,” Goldstein said. Folience recently received the National 2022 Employee-Owned Company of the Year award from the ESOP Association.

“I’m careful to tell everyone that we’re not the biggest, best, or most profitable ESOP, but if we can achieve this, if we can make a difference for our employees, then every employee-owned company can do the same.”

Timberline Manufacturing Company, a Marion-based assembler of wire harnesses and control boards, has been 100% employee owned since 2012. Tom Pientok, Timberline’s CEO, credits the

ESOP with improving the company in ways that benefit both the employees and customers. “As a result of the ESOP, our employees work harder and smarter, produce better quality products, and are more innovative,” Pientok said.

Joy Donald, CIRAS strategic advisor, encourages business owners faced with a transition decision to consider the ESOP structure. “It allows them to preserve their legacy while benefitting the employees that they care about,” she said. “This single decision can alter the trajectory of employees’ lives in a way that is profoundly fulfilling.”

While there are sound reasons for transitioning to an ESOP, Donald noted there are potential challenges as well. “ESOPs have a built-in pressure to

maximize individual and corporate productivity—getting the most value possible from every asset, including people,” Donald said. “This can lead to terrific company value, but it’s important to intentionally manage this pressure to prevent employee burnout.”

Businesses that use ESOPs reap multiple benefits, but the structure isn’t for everyone. Companies with a small workforce, high turnover, or low profits may not be strong candidates for employee ownership. “First, I am a strong advocate of ESOPs, but if there are too few employees, the level of expense and compliance will be burdensome,” said Lindy Ireland, vice president of BCC Advisers, a company whose expertise includes ESOP valuations.

“If the profitability trend is consistently downward, there will be a corresponding downward trend in share value, which would not be an appropriate investment for an employee benefit plan. Also, if there is high turnover in your workforce, a lot of effort will be spent putting people in and taking people out of the plan, which isn’t beneficial for anyone.”

Finally, Ireland noted that fiduciary responsibility is required for the ESOP, which includes careful documentation for the IRS and the Department of Labor to ensure rigorous due diligence has been applied to oversight of the plan.