Here is CIRAS’s quick look at major economic indicators for Iowa. For an introduction and a description of the indicators used, see our first post.

| Indicator | Status | Underlying Data | Notes |

| ISM Manufacturing PMI® |  |

Manufacturing contracted for the third consecutive month. Most measures continue to indicate moderate general slowing in manufacturing, except employment and inventories, which continue to grow. | |

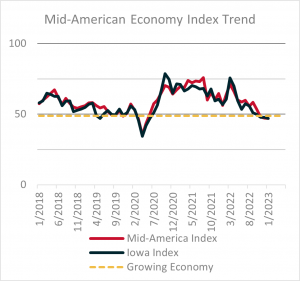

| Mid-American Index |  |

The Midwest continued to contract with mixed fundamentals. Inventories dropped significantly, while production remained flat and lead times grew. | |

| Iowa Index |  |

Iowa remained near neutral on most indicators, except for drops in employment and inventories and an increase in lead time. | |

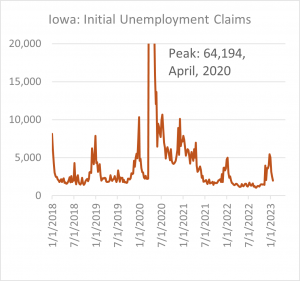

| Iowa New Unemployment Claims |  |

Initial unemployment claims have dropped to normal levels, and manufacturing claims have also dropped to at or below historical data. |

CIRAS Assessment

We continue to see mixed signals from Iowa’s manufacturing economy,with recent data showing better signals than last month. Orders, inventories, and employment indices are dropping while production remains flat and lead times grow.

Initial unemployment claims demonstrate that while production employment may be dropping in the surveys, it is likely more due to the inability to find people than layoffs. Today’s announcement on January national jobs data with strong growth overall and in manufacturing reinforces that while demand and production have dropped, businesses are still adding people to meet projected demand levels.

The conflict between inventories dropping and lead times growing may be an early sign of stabilizing of the manufacturing economy. CIRAS sees manufacturers of all sizes going through the process of normalizing inventory levels to balance risk and cash flow, a departure from stockpiling inventory for the past few years.

Leaders should focus on cross-functional conversations and communication between the sales, production, and purchasing departments. Communication of projections, including the risks and ranges of those projections, is critical in stabilizing operations within your business and across supply chains.

If you would like a brief monthly digest with updated indicators, click here to subscribe. For more information, contact your local account manager or government contracting specialist.